- Get link

- Other Apps

The concept of money laundering is essential to be understood for those working within the financial sector. It's a course of by which dirty cash is transformed into clean money. The sources of the cash in actual are felony and the cash is invested in a approach that makes it appear like clean money and hide the identification of the legal a part of the cash earned.

While executing the financial transactions and establishing relationship with the brand new clients or maintaining current clients the obligation of adopting sufficient measures lie on every one who is a part of the organization. The identification of such ingredient to start with is straightforward to deal with as a substitute realizing and encountering such conditions in a while within the transaction stage. The central financial institution in any country supplies complete guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously present sufficient safety to the banks to discourage such conditions.

By means of money laundering criminals attempt to transform the proceeds from their crimes into funds of an apparently legal origin. So Money Laundering is a way to hide the illegally acquired.

Anti Money Laundering And Counter Terrorism Financing Law And Policy Showcasing Australia Brill

The money laundering process can be broken down into three stages.

General definition of money laundering. Laundering allows criminals to transform illegally obtained gain into seemingly legitimate funds. Placement placing dirty money into a legal financial system. 1956 a 1 a defendant must conduct or attempt to conduct a financial transaction knowing that the property involved in the financial transaction represents the proceeds of some unlawful activity with one of the four specific intents discussed below and the property must in fact be derived from a specified unlawful activity.

Those in the regulated sector are required to report knowledge or suspicion or where they have reasonable grounds for knowing or suspecting that a person is engaged in money laundering ie has committed a criminal offence and has benefited from the proceeds of that crime. The process of taking the proceeds of criminal activity and making them appear legal. As mentioned above the definition of money laundering includes the proceeds of any crime.

Layering transferring or changing the form of money through complex transactions to obscure the origin of funds. Money laundering the process by which criminals attempt to conceal the illicit origin and ownership of the proceeds of their unlawful activities. It is a worldwide problem with approximately 300 billion going through the.

This process is of critical importance as it enables the criminal. Firstly the financial institutions are weakened directly through money laundering as there seems to be a correlation between money laundering and fraudulent activities undertaken by. To be criminally culpable under 18 USC.

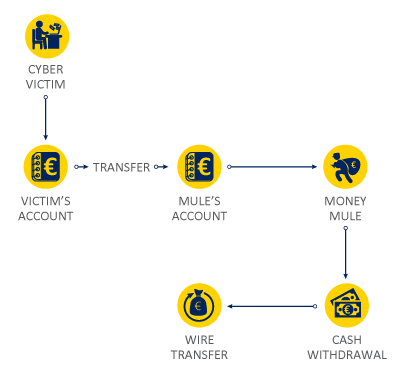

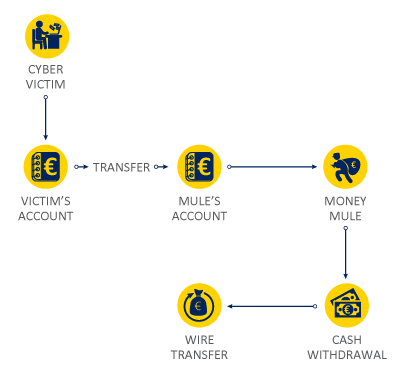

In principle cyber-laundering is the same as the conventional money laundering practice which consists of three stages. Money laundering is the processing of these criminal proceeds to disguise their illegal origin. 12 Definition of Money Laundering 121 Money laundering is any process used by criminals in an attempt to conceal the true origin and ownership of the proceeds of criminal activities ie a specified offence3 or drug trafficking.

A Three-Stage Process Smurfs - A popular method used to launder cash in the placement stage. Money Laundering impairs the sustainability and development of financial institutions in two ways. Money Laundering refers to converting illegally earned money into legitimate money.

Money laundering refers to a financial transaction scheme that aims to conceal the identity source and destination of illicitly-obtained money. First the illegal activity that garners the money places it in the launderers hands. If undertaken successfully the money can lose its criminal identity and appear to be legitimately derived.

About Business Crime Solutions - Money Laundering. If undertaken successfully it allows them to maintain control over those proceeds and ultimately to provide a legitimate cover for their source of income. Definition of money laundering Money Laundering is the process by which criminals attempt to conceal the true origin and ownership of the proceeds of their criminal activities.

Money laundering is the process by which criminals attempt to hide and disguise the true origin and ownership of the proceeds of their criminal activities thereby avoiding prosecution conviction and confiscation of the criminal funds. What is money laundering.

Money Laundering Meaning And Definition Tookitaki Tookitaki

What Is Money Laundering And How Is It Done

What Is Money Laundering Three Methods Or Stages In Money Laundering

Understanding The Risks Of Money Laundering In Sri Lanka The Lakshman Kadirgamar Institute

Pdf Evaluating The Control Of Money Laundering And Its Underlying Offences The Search For Meaningful Data

Cryptocurrency Money Laundering Explained Bitquery

Understanding The Risks Of Money Laundering In Sri Lanka Daily Ft

Anti Money Laundering And Counter Terrorism Financing

How Money Laundering Works Howstuffworks

Pdf A Review Of Money Laundering Literature The State Of Research In Key Areas

What Is Money Laundering Three Methods Or Stages In Money Laundering

Corruption And Money Laundering The Nexus Way Forward

Money Laundering Crime Areas Europol

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Online Presentation

The world of regulations can look like a bowl of alphabet soup at occasions. US money laundering regulations aren't any exception. We now have compiled a list of the highest ten cash laundering acronyms and their definitions. TMP Threat is consulting firm focused on protecting monetary companies by lowering threat, fraud and losses. We have huge financial institution expertise in operational and regulatory threat. Now we have a powerful background in program management, regulatory and operational risk as well as Lean Six Sigma and Business Course of Outsourcing.

Thus cash laundering brings many hostile consequences to the group because of the risks it presents. It increases the probability of major risks and the chance price of the financial institution and ultimately causes the bank to face losses.

Comments

Post a Comment